Month End Procedures

The final receiving needs to be completed for the month. It is important not to start receiving product for the new month until all products for the previous month have been received.

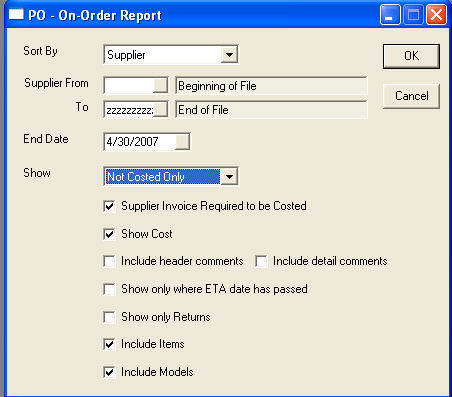

Once all product has been received, you can run the PO-14 - On-Order Report to show all product that has been received, but no invoice has come in. This is more of an issue with serialized goods than items, as most items arrive with an invoice, so receiving and costing are done together.

This report is required to balance your Inventory Valuation report to the Inventory Asset Control account in the GL. Product that has been received but not costed will be accounted for in the Inventory Valuation report with whatever value it was received at, but nothing will appear in the GL since the supplier invoice has not been entered into accounts payable, which is what updates the GL.

Purchasing Variables: General tab has options for both item and model quoted cost defaults. These defaults are carried forward during receiving as the unit cost. Based on these options the product will be listed on the Inventory Valuation report with a cost even though it has not been costed yet. It is beneficial for sales analysis, commissions and other reporting to have this cost in place even though it may change once the invoice arrives.

The value of the product listed on the PO 14: The On-Order report needs to be subtracted from the Inventory Valuation to balance to the GL Inventory Asset Control account. This balancing step cannot be done until the invoicing month end is completed.

Item Inventory

Purchasing month end must be completed before the item inventory month end can be done. You must also make sure all invoicing is complete. Invoices do not need to be posted, but inventory needs to be committed.

Run the IN-12 Inventory Valuation report. It is your choice if you run it in summary or detail, but detail is definitely needed for year end. There are three sets of totals on the valuation report. Most people will use the ‘Lower Cost’ column. Item inventory uses a combination of true and average costing procedure, which means all items sold on non-warranty invoices will be costed at average cost, but warranty invoices will be costed at true cost. With this costing method there will always be a small variation between the Inventory Valuation report and the GL Inventory Asset account. This will be adjusted at year end. The balancing step of the IN-12 Inventory Valuation report and the GL Inventory Asset account cannot be done until the invoicing month end is completed.

Serial Inventory

Purchasing month end must be completed before the serial inventory month end can be done. You must also make sure all invoicing is finished and posted. This is different than item inventory that does not require the invoices to be posted.

Run the SN-13 Valuation report. It is your choice if you run it in summary or detail, but detail is definitely needed for year end. The option ‘Print Serial’s Taken’ must be checked. Serial inventory uses the true cost of each and every serial number in all tracking. With this costing method, there should be no variation between the SN-13 Valuation report and the GL Inventory Asset account. The balancing step of the SN-13 Valuation report and the GL Inventory Asset account cannot be done until the invoicing month end is completed.

Invoicing

There is no real month end procedure that has to be done on a timely fashion except to complete all invoice posting for the previous month. Yesterday's invoices need to be finished and posted. This does not stop data entry or sales for the new month, except that we have to post invoices for the last day of the month before we can start posting the new month. This step must be completed before we can start the AR month end procedures.

Both invoicing and accounts payable have to wait for supplier invoices to arrive for product that came in at month end, so once all invoices have come in, we start our invoicing month end. From an accounting perspective, EPASS makes revenue entries as invoices are posted, but Cost of Goods Sold is only done at month end. We do this because product arrives and gets sold/shipped before the invoice from the supplier has arrived. If we were to make COGS entries when invoices were posted, there would be countless adjustments to be made at month end for all the cost changes.

OE-14 Invoice Cost Exceptions: this report will show all invoices with items/product sold at zero cost. You should not need to check the Include Misc. Charges option. Running this report after all supplier invoices have come in for last month, there should be very few serial lines on the report. When a PO is costed EPASS automatically updates serial sales history, serial inventory, customer history and invoicing for product that is already sold.

Serial entries on this report are corrected through Serial Inventory > Sales Changes. Item entries are corrected directly on the invoice detail. Item lines will allow you to edit the cost even after the invoice is finished. If you seem to have excessive item lines on this report, you may want to consider turning on an option in Item Inventory variables that will take the most current item cost when the invoice is finished. Item Inventory Variables > General tab > Update Item Cost During Finish Inv.

Everything on this report needs to be corrected prior to the GL Cost Posting for an accurate Cost of Goods Sold.

Invoicing Menu > Invoice G/L Cost Posting: This will post the GL Cost of Goods for you. There is a preview option available. If you decide to run this procedure at different times during the month to produce COGS on a mid-month basis, then only run it for the limited date range. Even if you ran it multiple times for the same period, EPASS will never duplicate COGS, it keeps track of each invoice and that the COGS has already been posted.

Accounts Receivable

AR month end is usually done the first morning of the next month and is fairly time dependant. You cannot start posting AR for the next month until the previous month end has been completed. You can key in AR transactions and continue working in all other modules of EPASS without restrictions, just do not post AR.

The first step of invoicing month end must be completed before you start AR month end. This means you must complete all invoice posting for the previous month. This is not connected to the Invoice GL Cost Posting.

If your company uses service charges, then you need to run service charges on the AR menu. Service charges can be edited/deleted as needed through AR transactions prior to posting if needed. Individual customers can have the ‘Bill Service Charges’ option checked or unchecked on the ‘Credit’ tab of Customer Maintenance. The default for service charges is set in Tools > System Maintenance > A/R Variables > Customer 1 tab. Service charges must be posted through AR Post Transaction after running the service charges program.

If there are any adjustments that need to be entered, before printing statements would be a good time. This leads into doing the final AR posting for the month.

Although the AR menu > Drop Paid Invoices procedure can be run any time during the month, and as many times as necessary, it is usually run prior to printing statements. This way our statements are as short as possible, and customers who have paid their account in full, will not get a statement.

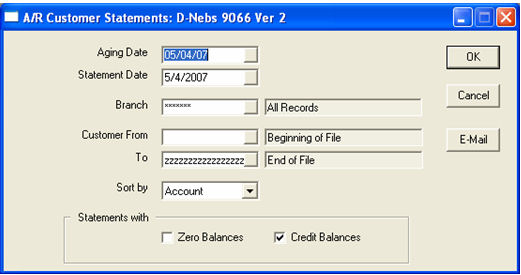

Customer statements are printed through the AR menu > Reports > Customer Statements.

Aging Date: This is used to calculate over 30/60/90 information.

Branch: If you have multiple branches, you can print statements for them separately.

Customer From/To: This would allow only an individual statement or a range of statements to be printed.

Sort By: Statements can be printed in name or account number order.

Zero Balances: Do you want accounts who have had activity and have paid their account in full to be printed?

Credit Balances: Do you want accounts with a credit balance to be printed?

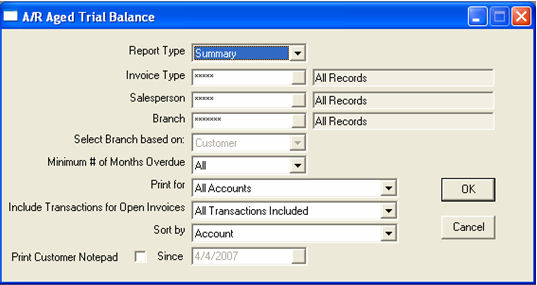

The AR-06 Aged Trial Balance report shows all accounts and their balances along with the totals for balancing to the GL accounts receivable control account.

Report Type: Summary or Detail. Detail is preferred.

Invoice Type/Salesperson: You can print restricted reports if you want them handed out to specific departments or salespeople to look at their AR.

Branch: If you select only one branch, then the option ‘Select Branch Based on’ becomes enabled. The options there are Customer or Invoice. When printing an Aged Trial Balance for a specific branch, is the customer based on the branch the invoice was written at, or is it based on the branch the customer belongs to.

Minimum # of Months Overdue: The options are All, 30+, 60+, 90+.

Print for:

- All Accounts: Print all customers.

- Open Item Accounts Only: Print only customers with the account type of Open Item.

- Zero Balance Only: Print only customers with a zero balance. These accounts need to be looked at because they probably have credits and debits that balance out, but are not being dropped.

- Credit Balance Only: These are customers with either deposits or a true credit on their account. When using this option in conjunction with ‘Include Transactions for Open Invoices’ = ‘True A/R – No Deposits from Open Invoices’ you will only see customers who have a true credit on their account and probably require a refund check.

Include Transactions for Open Invoices:

- All Transactions Included: Print all activity. This report will balance to your AR control account in the GL when the AR Variables > GL tab > Deposit Liability account is not filled in. This is not the standard, most companies have a deposit liability account in their balance sheet.

- True A/R – No Deposits from Open Invoices: Only show activity for finished invoices; exclude open invoices and their deposits. This is your true AR, what people actually owe you. This report should balance to your AR control account in the GL as long as the above mentioned deposit liability account is filled in.

- Only Deposits from Open Invoices: This will only show deposits/payments on open invoices. This report will balance to the deposit liability account in the GL.

Sort By:

- Account: Print the report in customer account number order.

- Name: Print the report in customer last name order.

- Print Customer Notepad: Do you want notes since a certain day to print on the report. The customer notepad is commonly used for collection notes.

Accounts Payable

Accounts payable is not usually closed until the bank statement and other final invoices arrive from suppliers. This is quite commonly 7 to 10 days. This does not stop you from continuing with the next month’s AP.

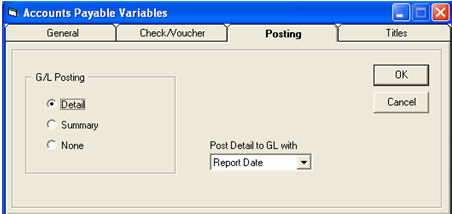

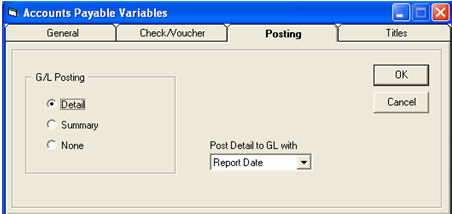

Accounts Payable variables has one very important option we need to understand:

Post Detail to G/L with – Report Date: This option will write all entries to the GL using the report date, or the date you are signed into EPASS with. This would mean an old invoice from March that arrived in late April, well after March was closed off, will be written to the GL as April. This is the most common choice.

Transaction Date: This option will write entries to the GL using the transaction date you entered in AP transaction processing. In the example above, the March invoice arriving late would be posted to the GL as March, not April. This option requires that you are more careful with your transaction dates, but does allow you to post invoices to a prior period, which will make the GL more accurate.

Both methods are correct, it just depends how you want to run the system. The choice of methods will affect some of the reports we choose later on in AP month end and they will be noted.

Once you have decided that all the bills you are going to wait for have arrived, you need to do a final AP posting for the month. The key is to sign in as the last day of the month prior to running the posting. You can enter transactions for the new month, but do not post the new month prior to closing the month. If you must post the AP transactions for the following month prior to closing the current month, then later on when we refer to running the AP-11 - AP Open Item report, you will use the AP-15 - Historical Open Item report instead.

N.B. When using ‘Posted Detail in G/L’ with ‘Report Date’ and you are posting the next month, make sure you first run a posting for the last day of the current month and accept that posting prior to running a posting for the next month. This will assure you that transactions are going to the GL with the correct month. When using ‘Posted Detail in G/L’ with ‘Transaction Date’ it is still a good practice to post in the same manner, but it is not critical.

Check reconciliation needs to be done once the bank statement arrives.

If you have inadvertently marked a check as Reconciled in the past that should not have been, you have the option in the top left to show reconciled checks since a certain date.

Click Reconcile to start the reconciliation process. This will allow you to toggle the reconcile yes/no option. This includes past reconciled checks if you have checked Show Reconciled and filled in a since date.

The Print option will print a report of all checks reconciled today.

Drop Paid Invoices: This is usually done prior to printing month end reports. AP variables > Check/Voucher tab has an option to Auto Drop During Check Run. This option should be checked. If you do not have this option checked, it is also advisable to run a drop paid prior to a check run. The drop paid invoices procedure matches invoices and checks and where invoices are paid in full, they are dropped from the AP current reports. This shortens and cleans up the reports, but no history is ever deleted or lost.

AP Check Register: After the check reconciliation is completed, this will show all outstanding checks. This will be needed to reconcile the bank account.

AP-15 - AP Aged Payables Report: This will show the closing balance of your AP. The total on this report should balance to your AP Control account in the GL.

General Ledger Month End

GL is done at any time. There are no time restrictions. You could even be a year behind and the GL will still continue to operate. Month end in all other modules must be completed prior to the GL month end.

Within the current fiscal year, you can make entries to any financial period required and reprint the financials, trial balance, and YTD transactions. If you are working in month 6 and discover a mistake in month 1, you can back date the journal entries to month 1, post for month 1, and then print all reports from month 1 onwards. You do not need to close any of the months again. You are still in whatever month you were originally. In the same vein, if you accidentally closed a month before you were ready to, you can still do the same steps described for posting entries back into month 1.

Once a year has been closed, you can still run all necessary reports for past periods/years, but you cannot modify a year that has been closed. In between year end and the time your accountant gives you the final year end adjusting entries, you can still key in journal entries and run all the necessary reports to produce interim financials; you just cannot post the months in the new year until the previous year was closed. This allows you to operate fully during that few months while the accountant gets back to you.

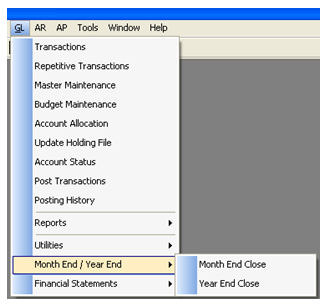

GL Month End steps

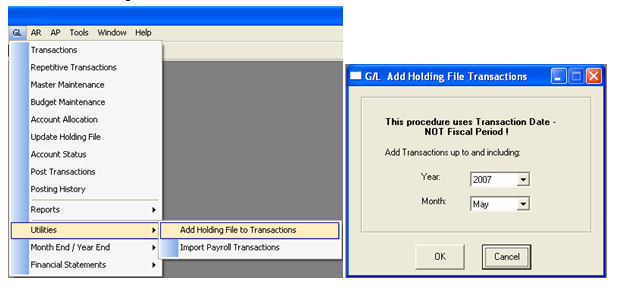

Utilities > Add Holding file

The Add Holding File to Transactions utility will transfer the data from all the other modules of EPASS into the GL. This can be run as many times a month as necessary, it will never duplicate transactions. It is important to remember this is based on transaction date, not fiscal period.

Transactions: Journal entries can be added at any time, for any period, you just need to be careful with the transaction date. All the entries added from the holding file in the previous step can be seen while in the transactions screen. Please do not edit or delete transactions brought across by the Add Holding File routine. If there is a mistake, add a journal entry to correct it.

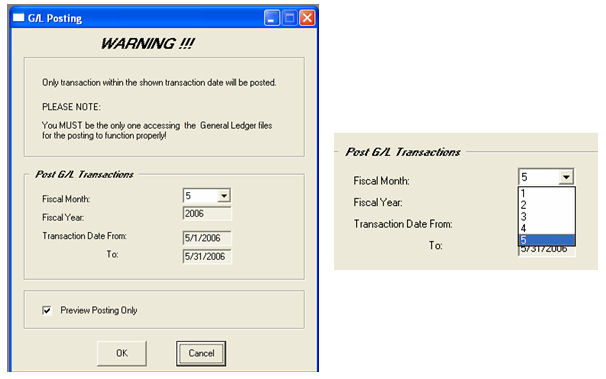

GL Posting

The GL posting procedure has a preview option just like all other posting procedures, but it is unique in that it allows you to select which fiscal month you are posting for. Our company is currently in fiscal month 5, but if you click the drop down arrow beside the fiscal month, it allows you to select any of the previous months this fiscal year.

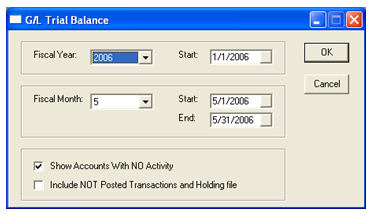

Reports - Trial Balance

The trial balance can be printed for any fiscal period. There are options for changing the fiscal year and month. The dates shown on the right are informational only, they change as you change the year and month on the left.

The option ‘Include not Posted Transactions and Holding file’ will allow you to print a trial balance before you have posted the transactions. It will automatically be selected if you pick a period in the future.

Financials are done in two steps. First you Prepare Financials, then you Print Financials. Both options are within the financial statements menu. As with the trial balance you can print any period in the past or future.

Month End Close

The Month End Close procedure increments the financial period. As previously mentioned, this does not restrict you from posting into a previous month or re-printing reports from a previous month. Within the same year, you can post into any period necessary. You CANNOT post into a previous financial year.

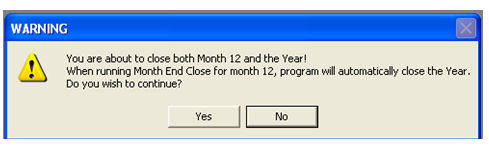

It is very important to remember that you cannot close month 12 until the year end is ready to be closed. Closing month 12 will automatically trigger a year end close. You can leave month 12 open for as long as necessary. The system will allow you to make journal entries and print reports for the next year even though you have not closed the current year.